Raising Series A funding lays the foundation for startups aiming to scale their operations and reach new markets. This pivotal stage in the startup lifecycle not only signifies a maturation of the business model but also attracts the attention of potential investors who are looking for promising ventures. Understanding what it takes to secure Series A funding is essential for founders who want to navigate this competitive landscape successfully.

This guide encompasses everything from preparing a compelling pitch to leveraging innovative business strategies that entice investors. We’ll delve into the intricacies of venture capital, risk management, and the importance of effective communication, ensuring that you’re well-equipped to embark on your funding journey.

Understanding Series A Funding

Series A funding represents a crucial stage in the lifecycle of a startup, marking the first significant round of financing after seed funding. This phase is vital as it allows companies to scale their operations, refine their product offerings, and expand their market reach. Typically, startups seeking Series A funding have already demonstrated some level of traction, whether through user growth, revenue generation, or product development, which sets the stage for attracting more substantial investment.Before reaching Series A funding, startups usually navigate several preliminary stages.

These include bootstrapping, seed funding, and perhaps even angel investments, which help validate their business model and achieve initial market traction. By the time they approach Series A investors, these startups should have a solid foundation, including a proof of concept and a growing user base. Investors generally look for common attributes in startups seeking Series A funding, such as a strong founding team, a clear business model, market demand, and the potential for significant growth.

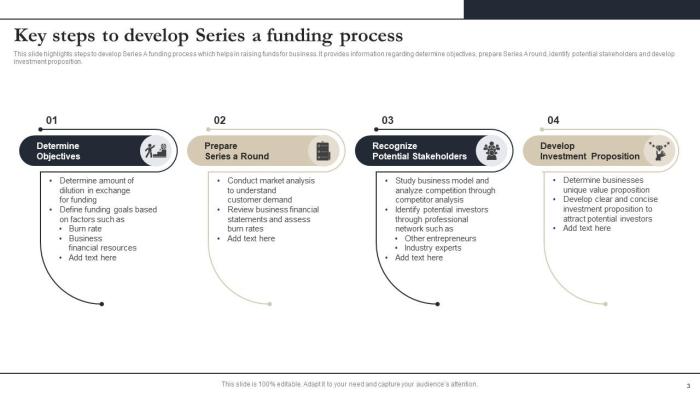

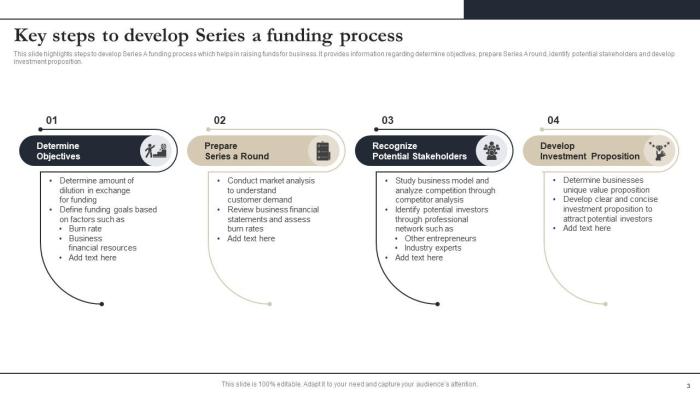

Preparing for Series A Funding

Preparation is key when it comes to securing Series A funding. Startups need to gather essential documents and materials that will bolster their pitch. These typically include a pitch deck, a detailed business plan, financial statements, and projections that illustrate the startup’s potential for growth. A well-prepared pitch not only showcases the business but also demonstrates the founders’ understanding of the market and their strategic vision.A solid business plan is vital, as it Artikels the startup’s objectives, strategies, and operational plans.

Financial projections provide investors with insight into the expected revenue streams and profitability timelines, and they must be grounded in realistic assumptions based on market research. To help founders prepare for investor meetings, here’s a checklist of essential items they should have ready:

- Comprehensive pitch deck summarizing business highlights

- Detailed business plan outlining market analysis and strategies

- Current financial statements and forecasts

- Clear value proposition and competitive analysis

- Evidence of traction, such as user metrics and growth rates

- Strong team bios and relevant experiences

Business Innovation in Series A Funding

Innovative business models are attractive to Series A investors because they often signal the potential for high returns. Startups that introduce new ideas or disrupt existing markets tend to capture investor interest more readily. Additionally, the role of technology and digital transformation cannot be overstated; startups leveraging cutting-edge technology can appeal to venture capitalists who are keen on supporting the next big breakthrough.Several startups exemplify the success of innovative approaches in attracting Series A funding.

For instance, companies like Robinhood revolutionized the financial services industry with a commission-free trading model, which led to significant investor interest and Series A funding success. Similarly, a startup that utilizes AI to enhance customer service processes can create a compelling case for investment.

Role of Venture Capital in Series A Funding

Venture capital plays a critical role in financing startups at the Series A stage. This type of funding provides the capital that startups need to scale their operations and achieve market fit. Different types of venture capital firms have various investment strategies, ranging from focusing on specific industries to prioritizing geographic locations or stages of business development.The negotiation process between startups and venture capitalists is often nuanced.

Founders need to be prepared for discussions around valuation, equity stakes, and funding terms. Strong negotiation skills can significantly impact the startup’s future, making it essential for founders to understand their worth and the factors influencing their valuation.

Business Networking for Investors

Networking is paramount when it comes to securing Series A funding. Building relationships with potential investors can lead to valuable introductions and endorsements. Founders should actively engage in networking strategies, such as attending industry events, participating in startup competitions, and leveraging online platforms like LinkedIn to connect with investors.Attending industry conferences provides opportunities to meet potential investors face-to-face, allowing for authentic connections that can lead to funding discussions.

Founders should also consider joining startup accelerators, which often provide mentorship and access to a network of investors.

Marketing Strategies for Attracting Investors

A tailored marketing plan can significantly enhance a startup’s visibility to potential investors. Creating a strong brand presence and effective public relations strategy plays an essential role in attracting Series A funding. Effective branding helps establish credibility, while PR can generate media coverage that highlights the startup’s achievements and milestones.Social media is another powerful tool. Startups can leverage platforms like Twitter, LinkedIn, and Instagram to share updates about their progress, engage with the community, and showcase their innovations to a broader audience.

Risk Management in the Funding Process

Raising Series A funding comes with inherent risks that startups must navigate. Common challenges include market volatility, competition, and operational scalability. Successful startups implement risk management strategies such as thorough market analysis, diversifying revenue streams, and securing legal protections.Due diligence is critical, as investors will scrutinize every aspect of the business before committing funds. Startups should prepare by having all necessary documentation in order, along with clear evidence of their business model’s viability.

Companies like Airbnb and Uber employed effective risk management tactics that minimized challenges during their funding rounds, positioning them for long-term success.

Team Building for Success

Having a strong management team is essential when seeking Series A funding. Investors often evaluate the team’s expertise, experience, and dynamics during the pitching process. Key roles such as the CEO, CTO, and CMO must be clearly defined, with each member showcasing their unique contributions to the startup’s growth.Startups can highlight their team’s strengths by presenting their past successes, relevant skills, and commitment to the company’s vision.

Demonstrating a cohesive and capable team can significantly enhance investor confidence.

Workplace Communication and Transparency

Effective communication between founders and investors is crucial throughout the funding process. Clear and transparent communication fosters trust and ensures that all parties are on the same page regarding expectations and progress. Startups should develop strategies to maintain open lines of communication, such as regular updates and proactive engagement.Maintaining transparency not only benefits the immediate funding discussions but also lays the groundwork for long-term relationships with investors.

A startup that communicates openly about challenges and successes is more likely to cultivate investor loyalty and support in future funding rounds.

Business Productivity Post-Funding

After securing Series A funding, improving productivity becomes a priority for startups. Techniques such as implementing agile methodologies, leveraging technology for automation, and focusing on team efficiency can boost operational effectiveness. Properly allocating resources is essential to maximize growth potential post-investment.Tracking key performance metrics is vital for assessing business performance after funding. Startups should monitor indicators such as customer acquisition costs, lifetime value, and revenue growth to gauge their success and make informed decisions moving forward.

Final Conclusion

In conclusion, mastering the art of Raising Series A funding is not just about securing financial resources; it’s about positioning your startup for long-term success. By understanding the key components—from building a strong team to implementing effective marketing strategies—you can enhance your chances of attracting the right investors. With the right preparation and mindset, your startup can soar to new heights fueled by the capital and insights gained during this crucial phase.

Top FAQs

What is Series A funding?

Series A funding is the first significant round of financing for a startup, aimed at scaling operations and attracting investor interest.

How do I prepare for a Series A pitch?

Prepare a solid business plan, financial projections, and a compelling narrative that highlights your startup’s potential.

What do investors look for in a startup during Series A?

Investors typically seek a strong team, innovative business models, market potential, and a clear path to profitability.

How important is networking in securing Series A funding?

Networking is crucial as it helps founders build relationships with potential investors and gain valuable insights from the industry.

What are common risks in raising Series A funding?

Common risks include market competition, financial mismanagement, and failure to meet investor expectations, which can be mitigated through thorough preparation.